MANYI ENO

Radio Station Manager

In the last issue, the article discussed the importance of where one receives his or her education and what employers look for in recent graduates.

Now let’s take a look at the consequences and other crucial factors students can face if they don’t pay back their loans on time.

The good thing is that a student doesn’t have to start paying back their student loans until after they are completely finished with college.

But once that diploma hits their hand and they finish their exit counseling, the payment reminders start rolling in after six months.

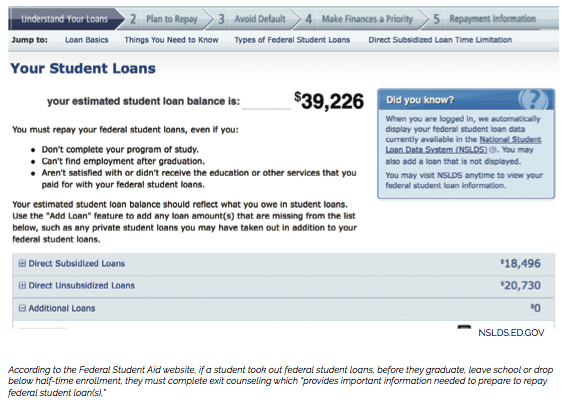

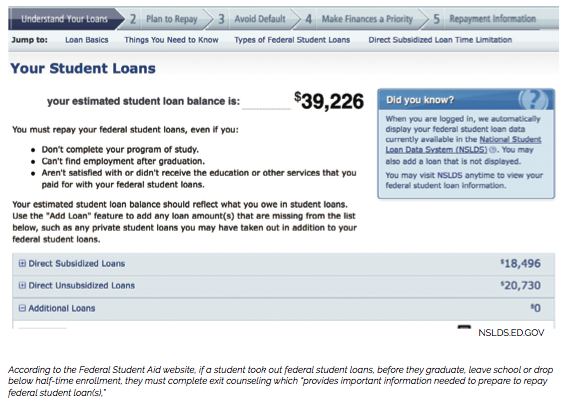

If a student took out federal student loans, before they graduate, leave school or drop below half-time enrollment, they must complete exit counseling that “provides important information [one] need[s] to prepare to repay federal student loan(s),” according to the Federal Student Aid website.

Unless a student earned a job straight out of college, the first six months after graduation might be one of the hardest and most frustrating months a college graduate may face.

However, if a student cannot come up with the amount of money he or she agreed to pay each month, the student could sign up to receive a deferment or forbearance.

Deferment or forbearance is postponing or reducing the payments on federal student loans, and this can prevent future damage to credit.

However, some students are hit with harsh realities after graduation– not only having trouble looking for a job but also not earning enough money from their first jobs to pay back the default amount needed to make monthly payments towards loans.

Contributing Writer for Forbes Magazine Jason Delisle recently reported that more people are not repaying their student loans than many would think.

The rate of federal student loans in default varies anywhere from roughly 11 to 15 percent from year to year.

Police even arrested one man in Houston, Texas earlier this year for not paying a $1,500 federal student loan he received back in 1987, according to Fox 26 Houston. U.S. Marshalls showed up at the man’s door and took him to federal court where he had to sign a payment plan.

If the man had refused to sign the payment plan, he would have been jailed.

Congressman Gene Green of Texas said that the federal government is now using private debt collectors to go after those who owe student loans, and there were 1,200 to 1,500 more people they were going after.

However, the police don’t usually come knocking down a person’s door for not paying a student loan.

Certain situations vary. For instance, the state lived in and if a prosecutor can prove that a person took out a student loan without the intent of ever paying it back impact the consequences.

For reasons such as this, a person could face jail time for fraud.

Another surprising reality is that student loans are the only debt people cannot file bankruptcy on. Unless financial hardship is proven in court, which is not granted lightly, they still need to pay off their student loans.

According to the Student Loan Borrower Assistance website, the most common test courts use is the Brunner test, which requires a showing that a person cannot maintain minimal living expenses and pay off student loans as well.

If a person has shown at least “good faith” efforts in trying to repay back his or her loans, the court may make an exception to forgive the debtor and cancel their student loan.

Students don’t fully understand the consequences that come with taking out loans to begin with. And, if these uncertainties continue to rise and more loans are taken out without full knowledge of the implications, students could face a long life of debt that they were not prepared for.

Look for the next and last article in the series as we take a look at ten tips on ways students can save while in college.